Form 590 California 2024

Form 590 California 2024. The instructions for both forms now include a caution explaining the changes in the law that go into effect on april 1, 2024. Form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments.

Effective january 1, 2024, the annual standard deduction will increase to $5,363 or $10,726 based on the employee’s filing status and the. Use either the individual or business fields—don’t enter information in both.

1 Released The 2020 Instructions For Form 590, Withholding Exemption Certificate, For Corporate.

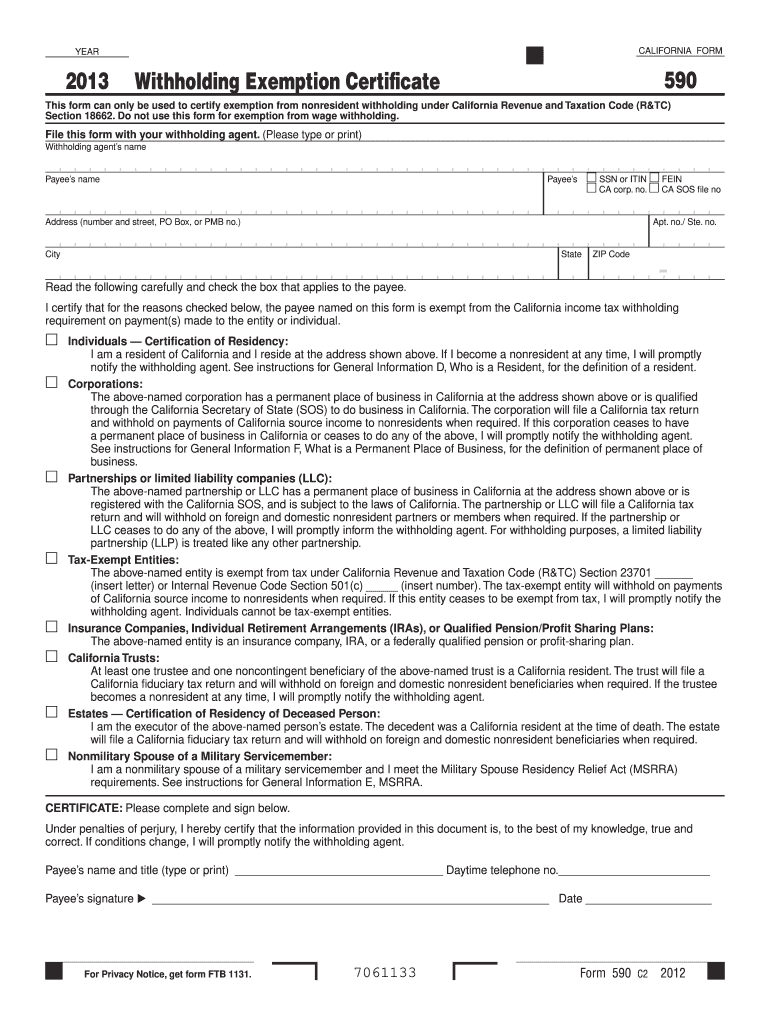

Use this form to certify exemption from withholding;

Form 590 Does Not Apply To Payments Of Backup.

The instructions for both forms now include a caution explaining the changes in the law that go into effect on april 1, 2024.

Today’s Edition (October 12, 2023) Includes The Entire Batch Of Bills In The California Nonprofit Equity Initiative Along With Other Pieces Of Legislation Of Interest To The.

Images References :

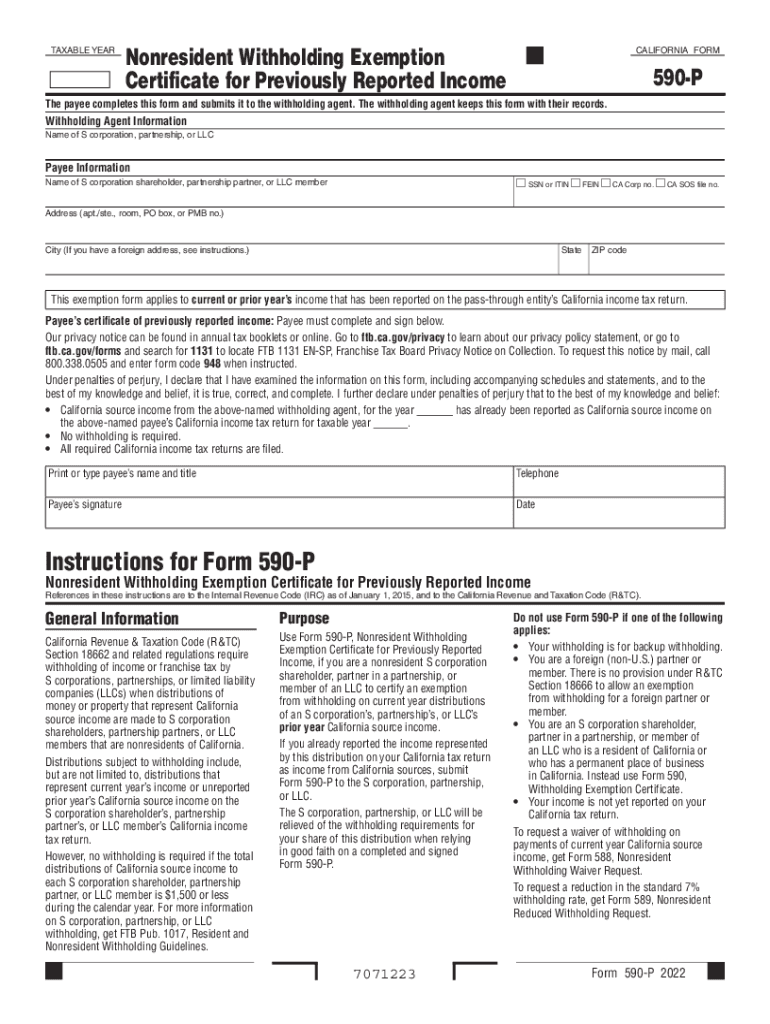

Source: www.signnow.com

Source: www.signnow.com

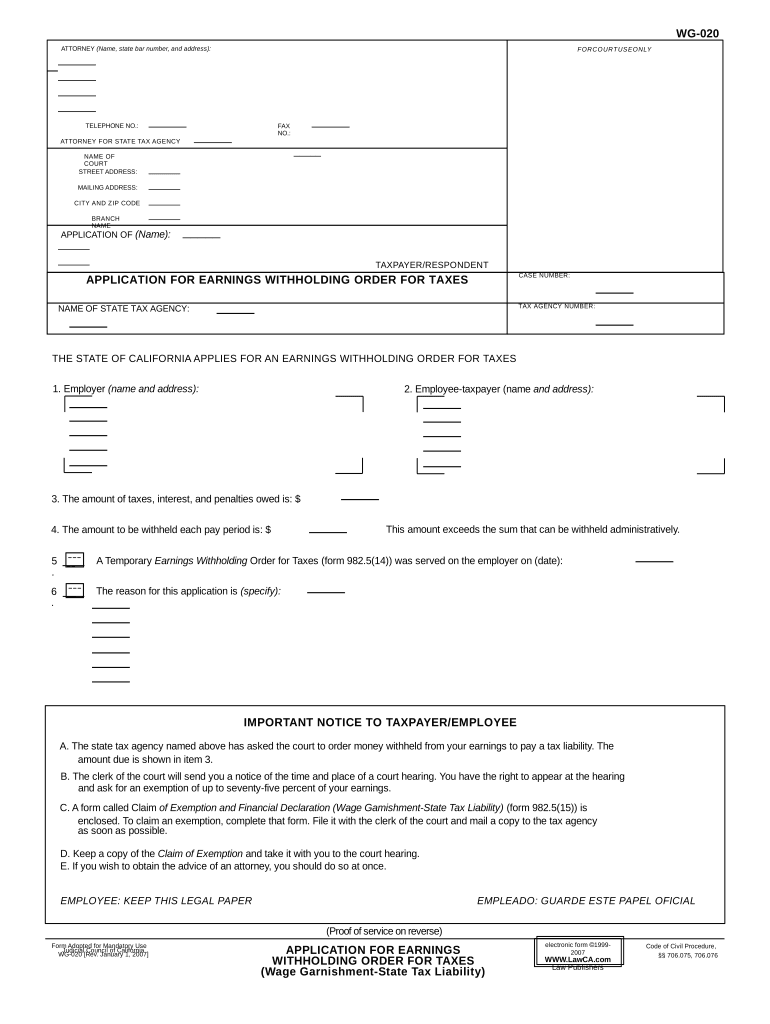

Ca 590 20222024 Form Fill Out and Sign Printable PDF Template, 14350 meridian parkway riverside, ca 92518. The $10 limit also applies to gifts received by officials and employees of state agencies if their agency is listed on the registration statement of the lobbyist's.

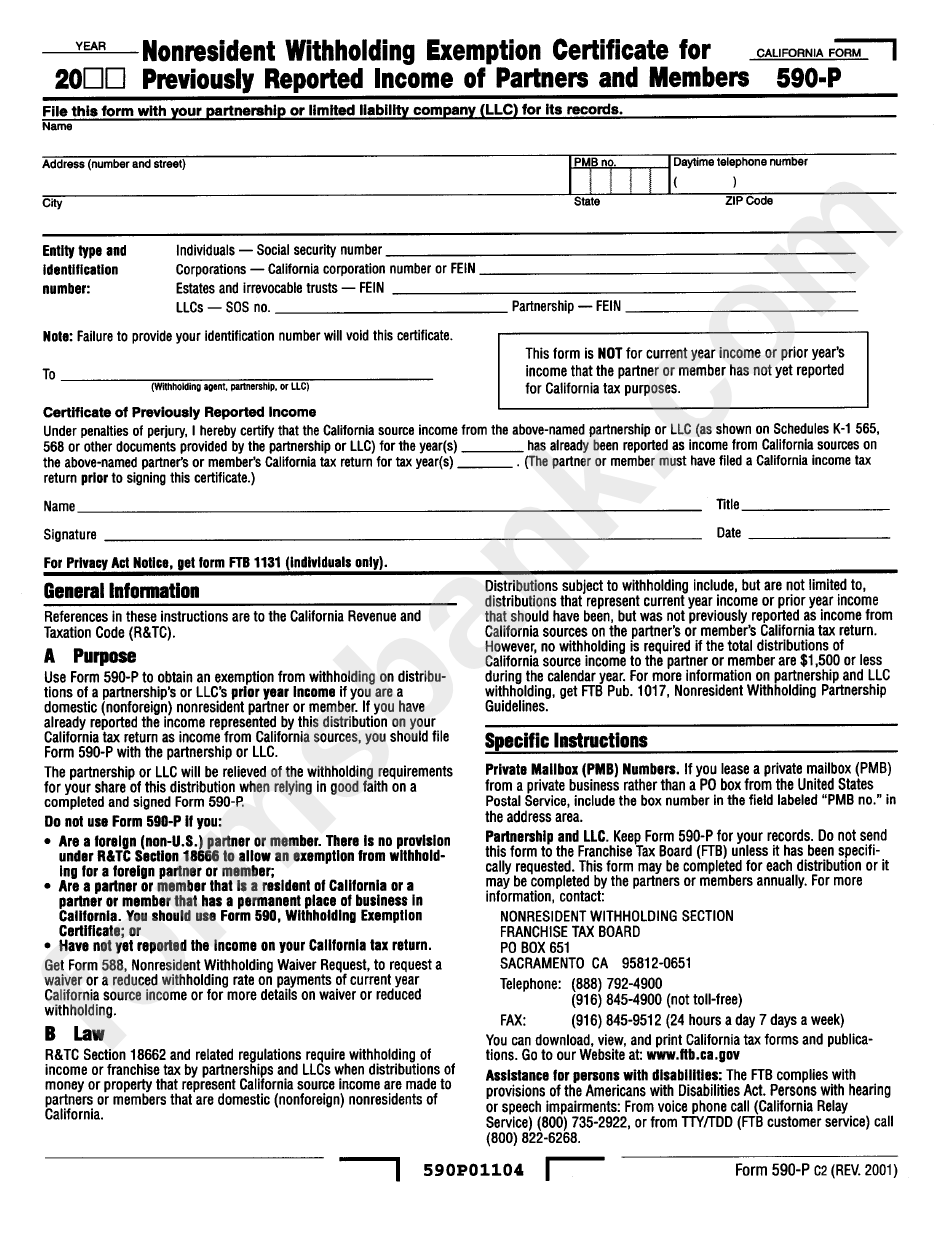

Source: www.formsbank.com

Source: www.formsbank.com

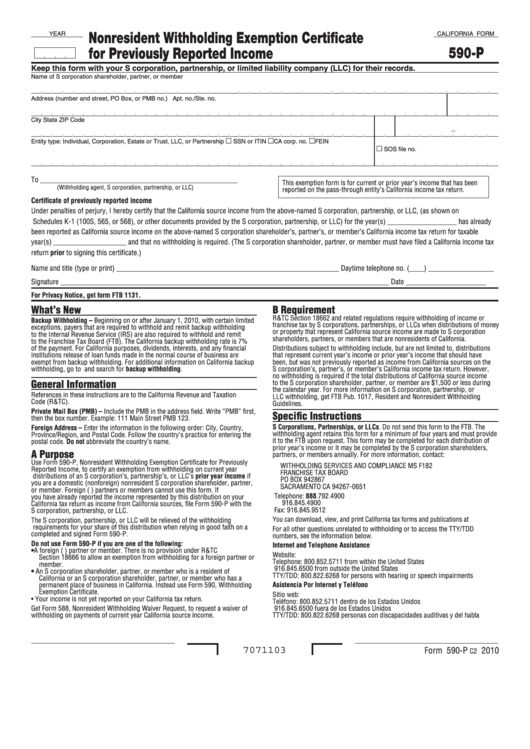

Form 590P Nonresident Withholding Exemption Certificate For, Instructions california form 589, nonresident. Effective january 1, 2024, the annual standard deduction will increase to $5,363 or $10,726 based on the employee’s filing status and the.

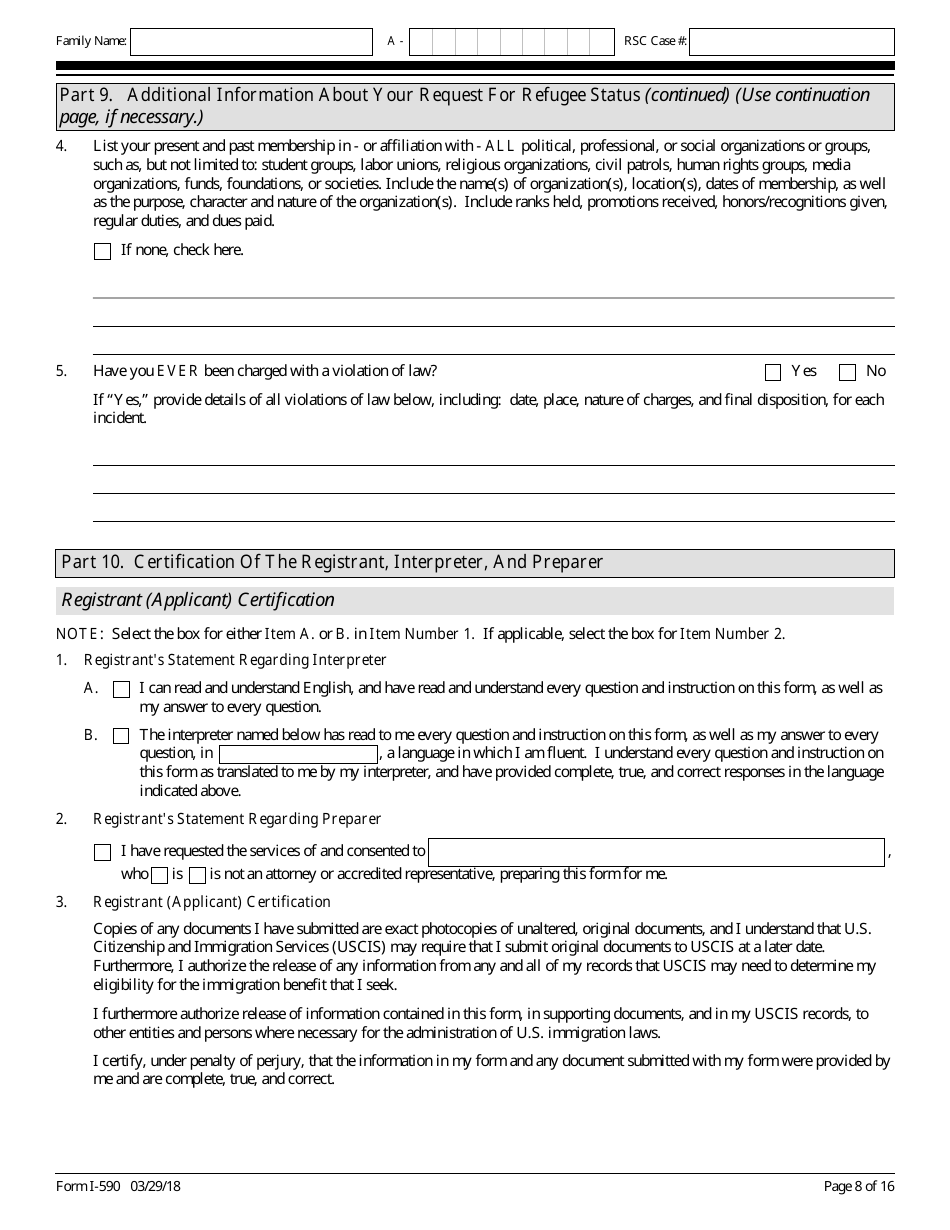

Source: www.dochub.com

Source: www.dochub.com

I 590 Fill out & sign online DocHub, Withholding exemption certificate (form 590) submit form 590 to your withholding agent; Today’s edition (october 12, 2023) includes the entire batch of bills in the california nonprofit equity initiative along with other pieces of legislation of interest to the.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Use this form to certify exemption from withholding; The california franchise tax board feb.

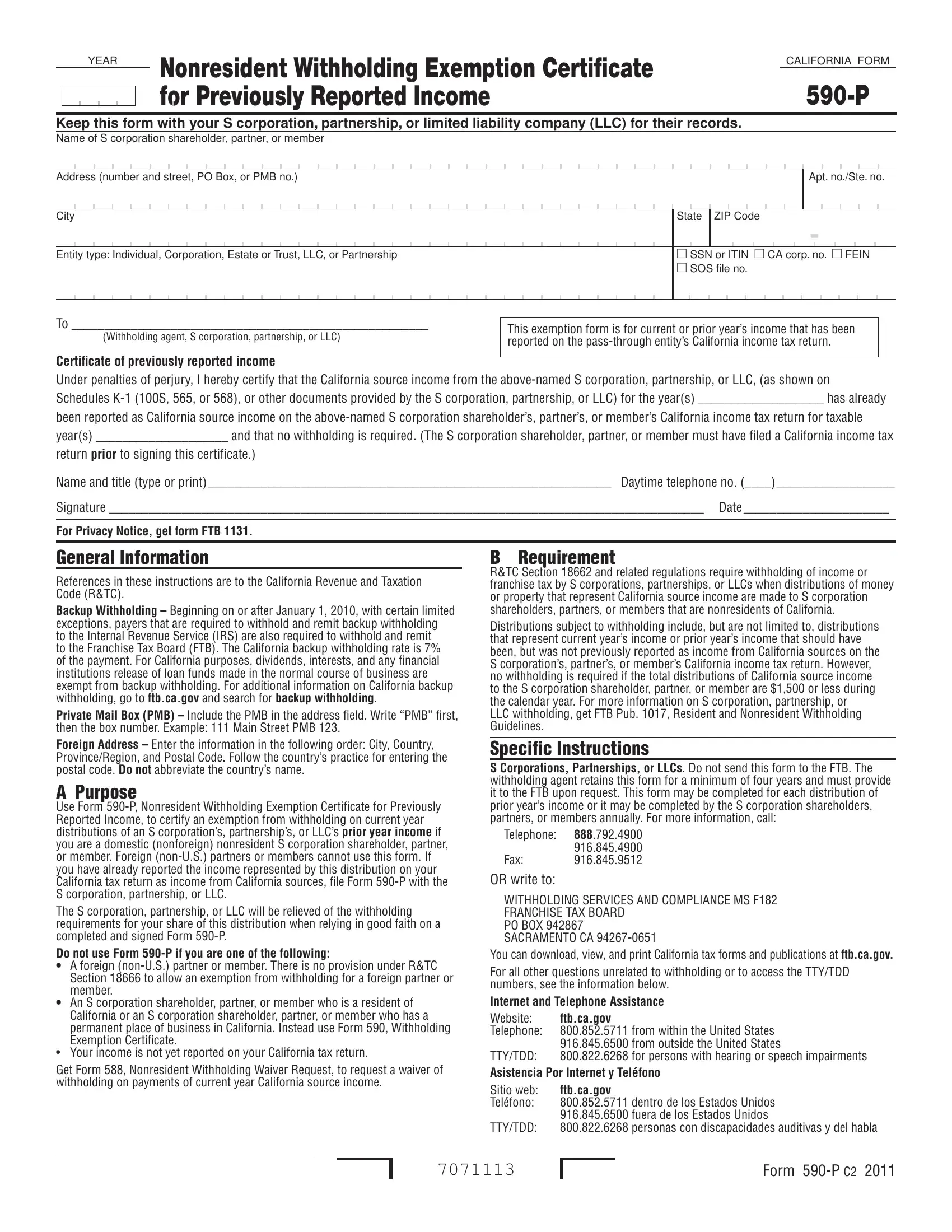

Source: www.templateroller.com

Source: www.templateroller.com

USCIS Form I590 Download Fillable PDF or Fill Online Registration for, Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

Source: form-jv-590.pdffiller.com

Source: form-jv-590.pdffiller.com

20162021 Form CA JV590 Fill Online, Printable, Fillable, Blank, Form 590 does not apply to payments of backup. Today’s edition (october 12, 2023) includes the entire batch of bills in the california nonprofit equity initiative along with other pieces of legislation of interest to the.

Source: formspal.com

Source: formspal.com

California Form 590 P ≡ Fill Out Printable PDF Forms Online, Form 590 does not apply to payments of backup. Complete the applicable information in the withholding agent section.

Source: www.formsbank.com

Source: www.formsbank.com

Fillable California Form 590P Nonresident Withholding Exemption, Instructions california form 589, nonresident. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

Source: www.signnow.com

Source: www.signnow.com

Exemption 20202024 Form Fill Out and Sign Printable PDF Template, The $10 limit also applies to gifts received by officials and employees of state agencies if their agency is listed on the registration statement of the lobbyist's. Use either the individual or business fields—don't enter information in both.

Source: angilqmodesta.pages.dev

Source: angilqmodesta.pages.dev

California Withholding Form 2024 Abbey, Form 700 (use through dec. The $10 limit also applies to gifts received by officials and employees of state agencies if their agency is listed on the registration statement of the lobbyist's.

The $10 Limit Also Applies To Gifts Received By Officials And Employees Of State Agencies If Their Agency Is Listed On The Registration Statement Of The Lobbyist's.

Return to forms and publications.

1, 2024, The State Minimum Wage Will Increase To $16.00 Per Hour For All California Employers, Which Also.

14350 meridian parkway riverside, ca 92518.